owner draw quickbooks s-corp

Reduce your basis ownership interest in the company because they are equity transactions on your balance sheet. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop.

Solved S Corp Officer Compensation How To Enter Owner Eq

Say you open a company with your friend as equal partners each putting up 250000 in cash.

. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. Draws can happen at regular intervals or when needed. It is not necessary that s corp is a business enterprise.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. This is important to note since if your basis is reduced to zero your taxes get a bit more complicated. S generates 100000 of taxable income in 2011 before considering As compensation.

A reference for the steps can be found here. You MIGHT be able to get this to work if you set up the S-Corp in its own Q data file. But that would only apply if the S-Corp files its own return.

Set up draw accounts. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. Owners draws can give S corps and C corps extra tax savings The IRS tax implications are huge if youre an S corp or a C corp.

An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like. Select New in the Chart of Accounts window. Are drawings assets or expenses.

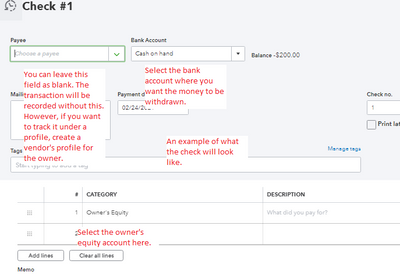

Make sure you use owners contributionsdraws equity vs. Youre allowed to withdraw from your share of the businesss value through an owners draw. Click Chart of Accounts and click Add Select the Equity account option.

Set up and pay an owners draw. How do I show owner pay in QuickBooks. Select Equity from the Account Type drop-down.

If you dont see your preferred bank account listed youll need to add it. Because there is in Quicken no such thing as an Equity Account or Owner Draws. Add other details of the check such as reference number memo etc.

Likewise the normal balance of the withdrawals account is on the debit side. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg.

A draw lowers the owners equity in the business. Smith Draws Post checks to. Under Category select the Owners Equity account then enter the amount.

Enter Owner Draws as the account name and click OK. Select Save and Close. Enter an opening balance.

If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep. In most cases you must be a sole proprietor member of an LLC or a partner in a partnership to take owners draws. Do drawings count as expenses.

Set up and pay a draw for the owner. However corporations might be able to take. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

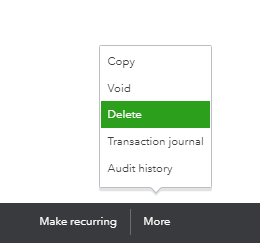

A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the balance of the owners equity. Once done click Save and close. The company can make the owner withdrawal journal entry by debiting the withdrawals account and crediting the cash account.

Draws can happen at regular intervals or when needed. Typically corporations like an S Corp cant take owners withdrawals. From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment.

Because of this most S-Corporation owners try to choose a low but reasonable salary. A owns 100 of the stock of S Corp an S corporation. Being a business owner there is no need to confuse between corp and s corporations.

The withdrawals account is a contra account to the capital in the equity section of the balance sheet. Select Owners Equity from the Detail Type drop-down. A is also Ss president and only employee.

S corporations and C corporations cannot take draws. If A draws a 100000 salary Ss taxable income will be reduced to zero. How do I record owners withdrawals.

You can adjust it based on your cash flow personal needs or how your company is performing. Also an accountant will be able to shed some more ideas about recording this. However corporation owners can use salaries and dividend distributions to pay themselves.

Select the Gear icon at the top then Chart of Accounts. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. The business owner takes funds out of the business for personal use.

An owner of a C corporation may not. Corporations should be using a liability account and not equity. Example 1.

How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window. How an owners draw affects taxes There are few rules. Due tofrom owner long term liability correctly.

According to IRS internal system those corporations that are elected to share the profit losses income deduction and credits to there shareholders for the purpose of paying federal taxes are called s corporations. An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw. And not part of your personal file.

Youd need Quickbooks for those features.

Solved S Corp Officer Compensation How To Enter Owner Eq

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Benefits Of Owning An S Corp Taking Distributions

Solved S Corp Officer Compensation How To Enter Owner Eq

How To Set Up A Chart Of Accounts In Quickbooks Qbalance Com

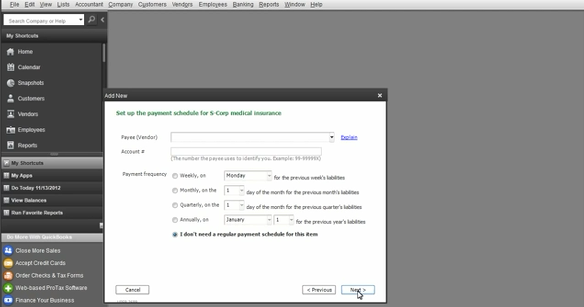

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

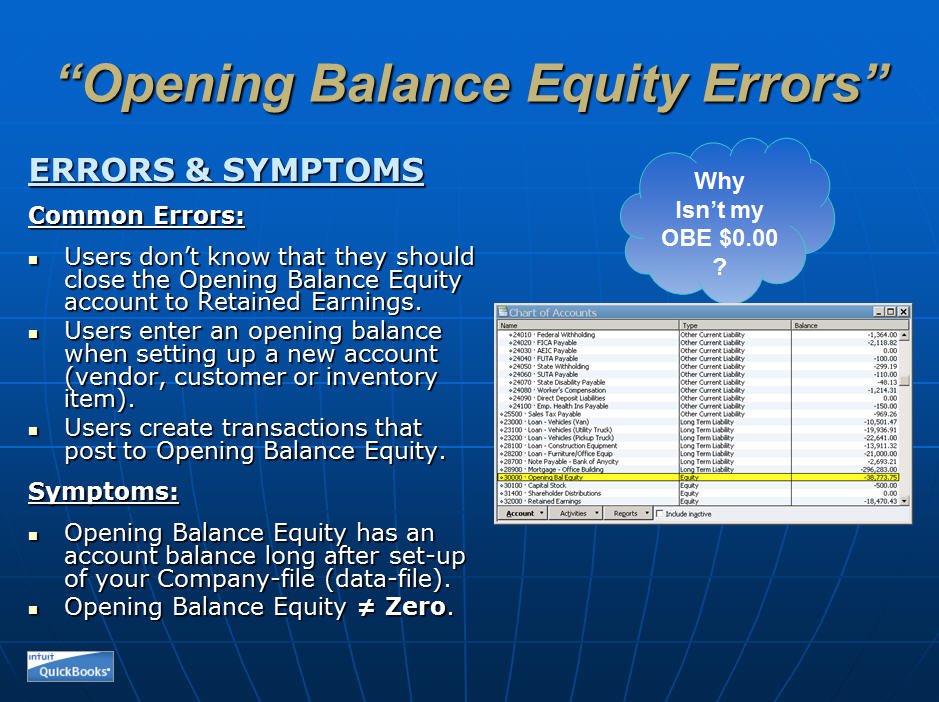

Same Old Problems Opening Balance Equity Insightfulaccountant Com

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

The Dual Tax Burden Of S Corporations Tax Foundation

Solved S Corp Officer Compensation How To Enter Owner Eq

What Is The Basis For My S Corporation Tl Dr Accounting

6 Essential Words To Understanding Your Business Finances Small Business Bookkeeping Small Business Finance Business Finance

Paystub Samples Professional Looking Templates Free Preview Payroll Template Paycheck Payroll Checks

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

Should I Become An S Corp Live Replay Youtube

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com